Deal Mechanisms for Strategic Business Partnerships in Biotechnology

By Nadia Carlsten | On September 21, 2015

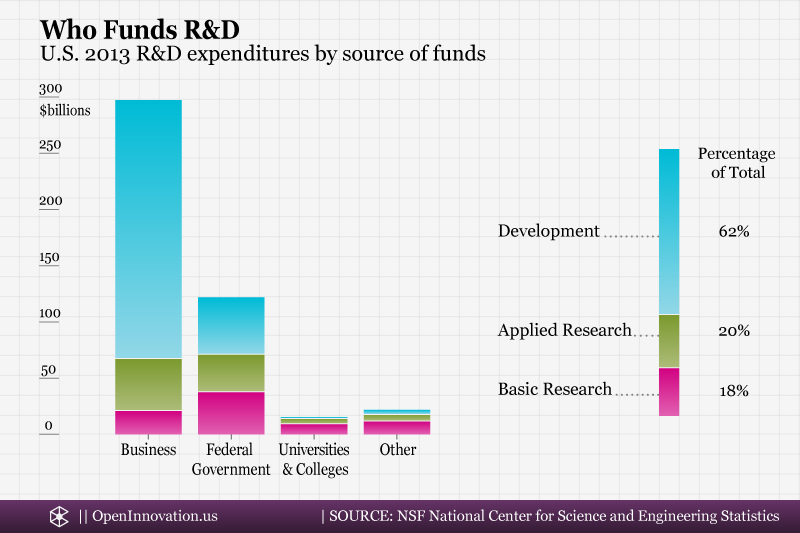

Deal making has gone hand in hand with biotechnology since the very beginning of the industry. The prevalence of these business arrangements is not surprising considering that it takes years for most biotech companies to develop a viable product, due in part to long research and development cycles and regulatory hurdles. One way for biotech companies to face the enormous costs and risks, and acquire resources and capabilities in a cost effective way is to partner with another entity. As R&D costs have continued rising since the early 1990s, the number of such biotechnology alliances has climbed steadily. 1

The biotech industry is also characterized by an exceptionally important ecosystem of innovation. Knowledge and capabilities are distributed among many players, including universities, government research laboratories, and companies of all sizes. While in years past it was common for technology to flow from universities and startups that focused solely on basic research to larger pharmaceutical companies with more resources, the types of technology transactions are becoming increasingly more diverse.

As the model of vertically integrated pharmaceutical companies becomes obsolete, successful companies keep their drug pipelines replenished by constantly looking for new products and technologies at all stages of development. Meanwhile, several biotech companies have been successful at expanding further into downstream research. As a result, while deals between pharmaceutical and biotech companies still make headlines, deals between biotech companies of different sizes and capabilities have become an integral part of the industry landscape: as reported in BioWorld, close to half of biotech deals in 2007 were collaboration and technology transfer transactions involving two or more biotech companies.

The types of deals biotechnology firms enter into are entirely dependent on the particular situations of the two (or more) companies involved and their respective needs. However, the deal is generally a mechanism for the partnering companies to transfer capabilities and intellectual property (IP) in return for an arrangement on sharing future revenues, as well as a way to enter into commitments to combine capabilities and resources in pursuit of common interests. The agreements that are at the heart of these deals can be complex, and commonly encountered ones in biotech include:

Licensing agreements:

Licensing agreements are very common in the biotech industry, and are often also part of other collaboration or partnerships deals. A license is a way for a company to obtain the “freedom to operate” by acquiring the rights to intellectual property developed by another entity, so that it can practice a method, or use or sell a product covered by the patent being licensed. They are used extensively by universities and research laboratories to generate revenues from their research activities, but can also be beneficial to biotech companies that own underutilized intellectual property.R&D Collaboration Agreements:

In many cases, a biotech company may want to enter into a collaboration with a partner that can contribute to the research and development of a technology or product. A good collaboration partner will have experience in a similar research area or bring in complementary capabilities, so that working jointly will benefit both partners. For smaller biotech companies and startups, having a collaboration agreement with a larger company can be an opportunity to receive funding that can help toward R&D costs. In addition, a collaboration with an established firm can often help validate the technology and send a positive signal that can lead to additional outside funding.Manufacturing & Supply Agreements:

Once a biotech firm has developed a product, it can benefit from partnering with someone that can build the capacity necessary to manufacture the product and maximize the commercial opportunity. A manufacturing and supply agreement enables this by structuring a commitment from one party to produce and sell the product on an exclusive basis to the other party, which commits to buying it at a specified price. This can enable a biotech company to get a product to market quicker, without the large capital investments required to build or expand its own capacity.Commercialization Agreements:

Commercial arrangements are a good way for a company to ensure that it is maximizing market breadth and reach. Commercialization agreements often result from options to co-promote or co-market the product of a research and development collaboration, but can also be used in later stages by companies seeking to expand presence in the marketplace by partnering with firms with marketing expertise and established sales forces. Commercialization deals include co-promotion agreements, where two companies join forces to promote a product under a single brand, and less common co-marketing agreements, where two separate brands are used to promote the same product.Joint Ventures:

Another option for biotech companies is to enter into a joint venture with another company. In this case, two companies with complementary capabilities join efforts by forming a separate legal entity that they own jointly. Both parties contribute resources, technologies and intellectual property to the new venture, and any technologies or IP developed as part of the collaboration belong to the joint venture. While it is possible for the biotech firm to essentially accomplish the same thing through a combination of research, development and commercialization agreements, this legal structure can have some advantages. In particular, joint ventures can offer a more level playing field for the smaller partner since they establish a management structure separate from that of the parent companies.

Partnerships between the different players in the biotech industry are an important mechanism for getting biotechnology products to market efficiently. Various types of agreement mechanisms are available to biotech companies depending on their needs, capabilities and goals, but choosing the right type of deal at the right stage of the company’s development is of paramount importance.

Notes

- Pugatch, M. , Torstensson, D., Chu, R. (2012). Taking Stock: How Global Biotechnology Benefits from Intellectual Property Rights. ^